Anza Resources

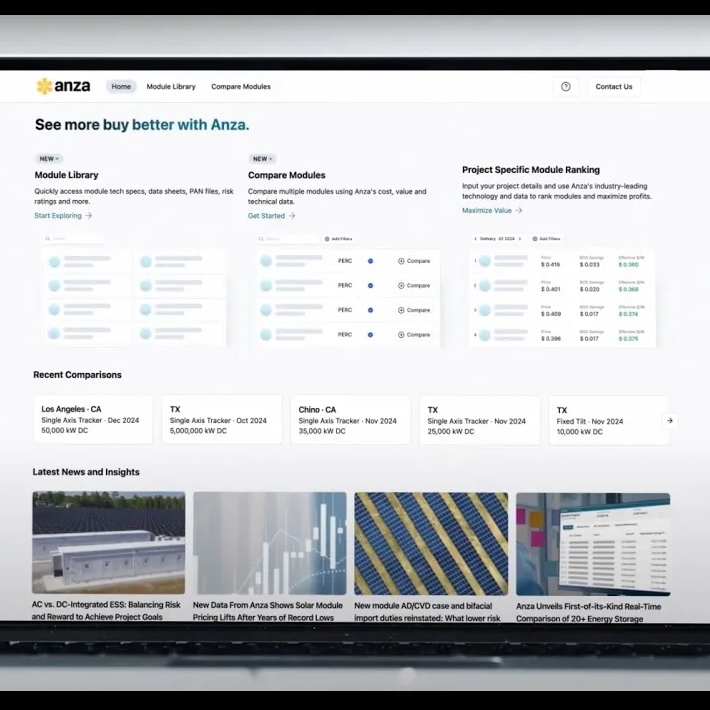

Access the latest solar resources and energy storage insights and learn more about Anza’s data and analytics platform.

-

|

How Anza has helped procurement clients navigate solar and storage market uncertainty with confidence

Determine your optimal solar module or BESS product strategy, stay up to date on market changes, and safe harbor products with Anza’s advisory services.

-

|

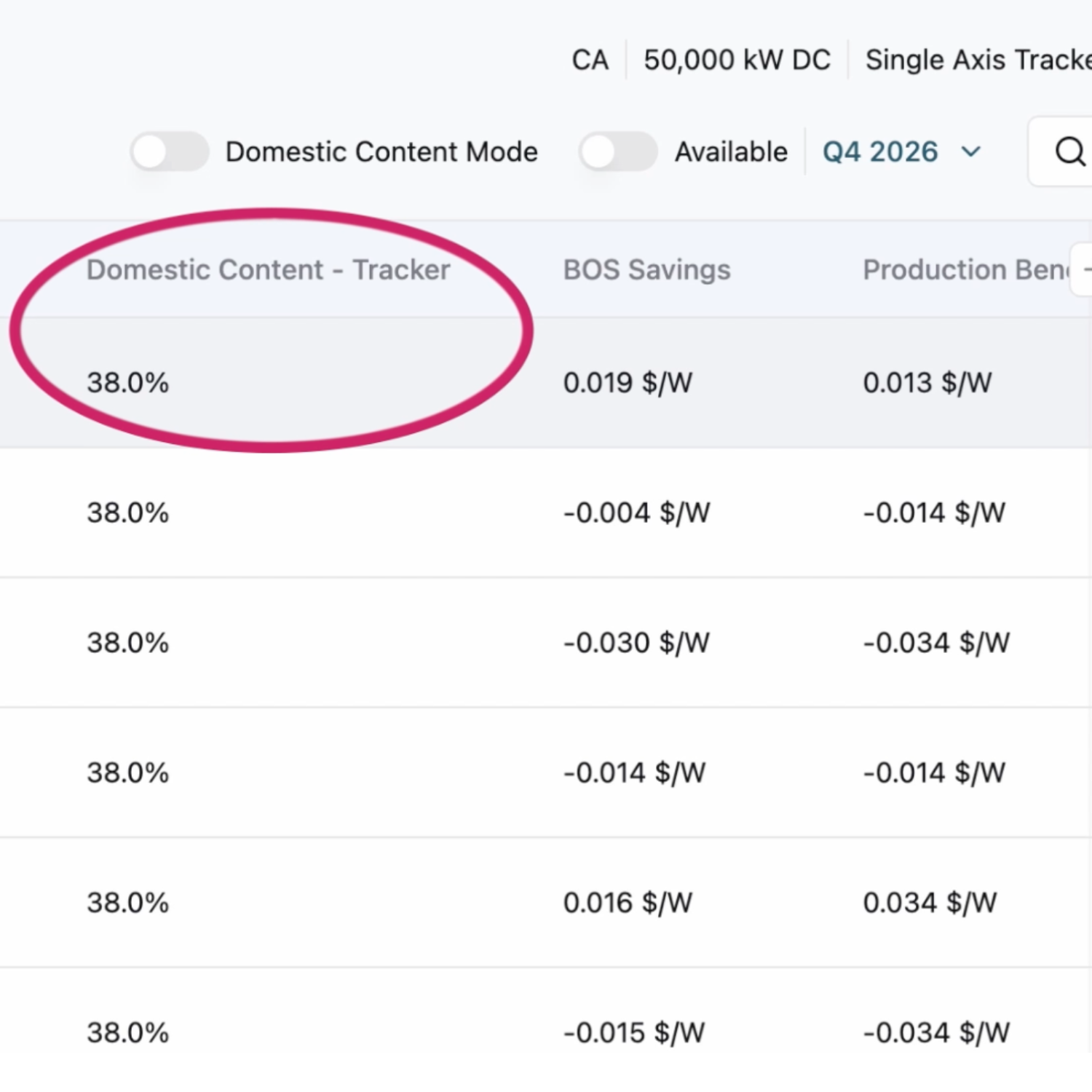

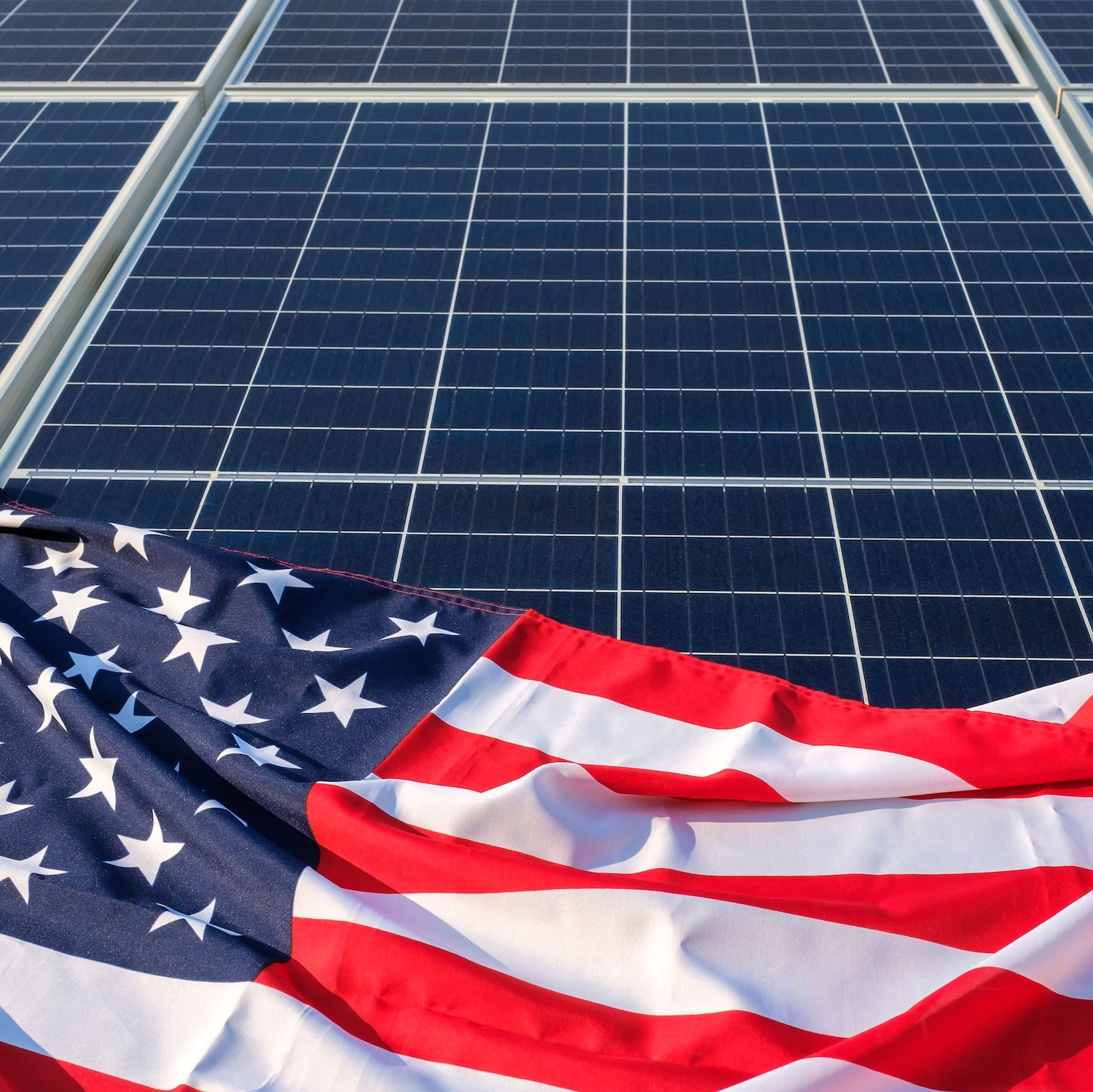

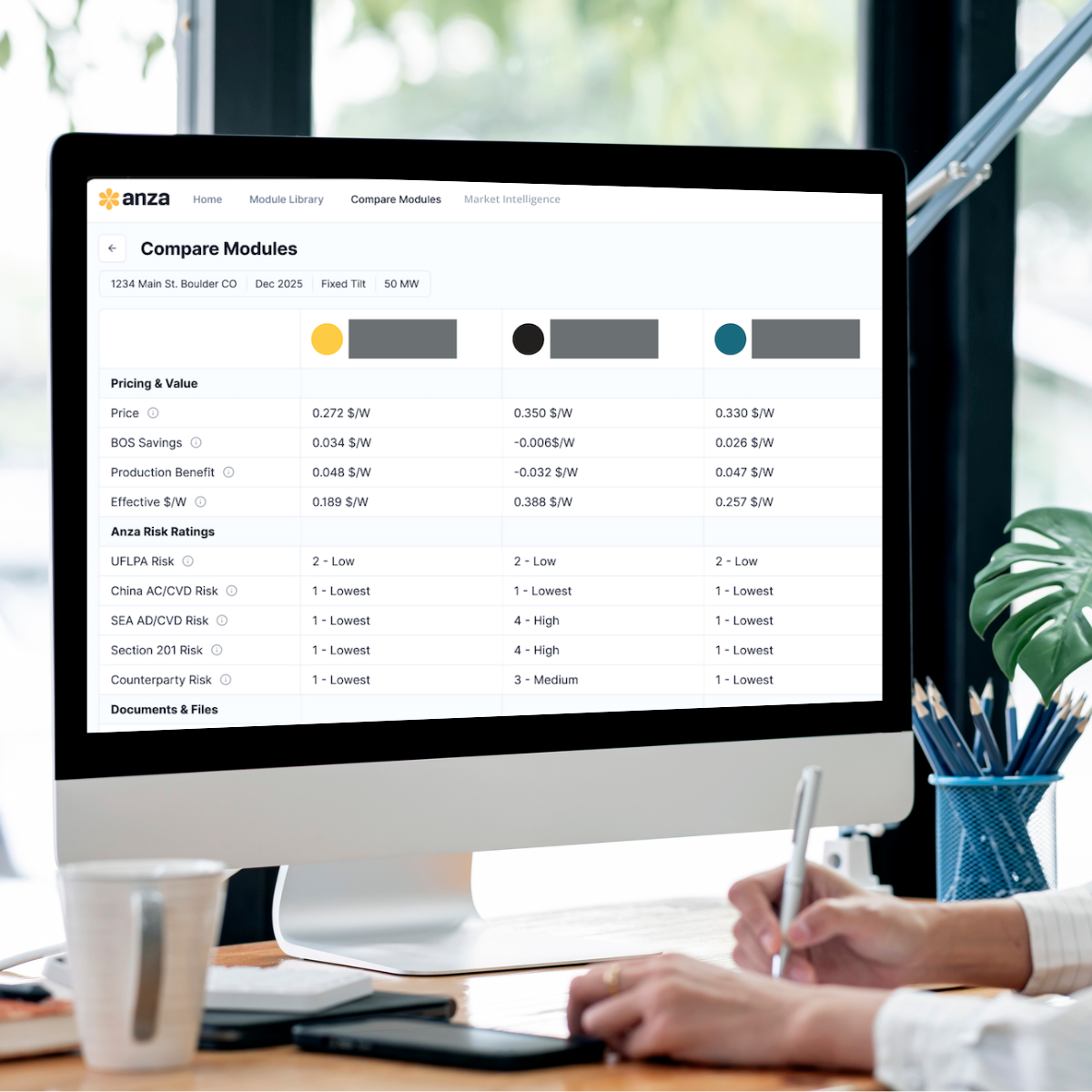

Unlock the domestic content bonus credit with optimal solar module blending

With Anza, you can instantly access the domestic content data you need to qualify for the bonus credit and optimize your portfolio while keeping capital costs tight.

-

|

Webinar: Achieving Optimal Solar and Storage Procurement Outcomes in a Challenging Market

Discover how Anza’s advisory services can help keep you current on the latest market changes and get the best price for your risk appetite.

-

|

Webinar: Revolutionizing Battery Storage Development with On-demand Data & Analytics

Hear from Anza clients how Energy Storage Pro helped them to eliminate time-consuming data collection and analysis processes, accelerate development decisions, and stay competitive in an ever-evolving market.

-

|

Speeding Up Energy Storage Development With Instant, Accurate Data and Automated Tools

With Anza’s Energy Storage Pro subscription, you can obtain the data needed for designs, finance models, RFPs and to defend your project valuation.

-

|

April 2, 2025 update: Latest tariffs & impact to solar and storage product strategy

Originally published April 3, 2025 and updated May 14, 2025 As anticipated, the change in presidential administration has come with new tariffs and adjustments to start 2025. After a scattered…

-

|

Anza Solar Domestic Content Blending Tool

With Anza, you can move faster and make confident, data-driven decisions on the optimal blend of domestic and imported modules.

-

GridBeyond Harnesses Anza’s Storage Platform to Expand Supplier Pool

By integrating Anza’s storage platform into its operations, GridBeyond saved time in its data collection process & laid a solid foundation.

-

|

Anza Customer Testimonial: APEX Clean Energy

APEX Clean Energy utilizes Anza to see more suppliers & data, increasing efficiencies and freeing up time to focus on supplier relationships.

-

|

How APEX Clean Energy Increases Development & Procurement Efficiencies with Anza

See how Anza helps APEX Clean Energy view the current state of the solar and energy storage landscape in less time.

-

|

Accelerating Solar Development Processes with Anza: Customer Testimonial

Hear from APEX Clean Energy, about why they recommend Anza to save time in solar development processes and procurement.

-

|

Energy Storage Pro | Subscription Data & Analytics Platform

With Anza’s Energy Storage Pro subscription, you can save months of time and improve project profitability & risk position with access to previously unavailable data & comparison tools.

-

How New Leaf Energy Uses Anza’s Module Data to Improve Its Solar Development Design Process

Working with Anza has enabled New Leaf to improve the accuracy of its solar module selection and easily defend decisions to project buyers.

-

|

Updated domestic content elective safe harbor guidance: What’s changing in 2025?

Take a closer look how the domestic content bonus credit qualification requirements have developed over time, what it means for your 2025 solar and BESS project strategy, and how Anza…

-

|

Current Tariff Risks for 2025 Solar Module and BESS Product Planning

What are the key areas of concern to be aware of as you plan your development and procurement product strategies for 2025?

-

|

The Value Of Data On Demand: Anza and Working Power on Dispatches from the Energy Transition

See how Anza’s platform has helped Working Power accelerate project development and increase its impact in this webinar, Dispatches from the Energy Transition.

-

|

Solar Domestic Content Webinar: Your Search and Strategy Simplified

Discover how Anza can help you easily answer your domestic content questions and hear from Anza customers on how we helped create a winning strategy.

-

|

Navigating Solar Domestic Content with Anza

With Anza’s data, analytics, and expertise, we can help you quickly and easily answer your domestic content questions.

-

Anza Helped NewSun Energy Navigate New AD/CVD Risk in Just Over a Month While Saving Millions

Learn how Anza helped our utility-scale client secure low-risk modules at the market’s lowest prices in the midst of changing trade issues.

-

|

2024 presidential election and solar tariff risk uncertainty: Is now the time to buy for solar and storage projects?

What solar tariff increases or new tariffs could be on the horizon with a Harris or Trump administration? Here are key factors to consider amidst the market uncertainties and tools…

-

|

How to efficiently analyze value and maximize profit with domestic content

In part three of our Domestic Content 101 blog series, we’re highlighting different domestic content strategies to help you maximize the value of your solar development or procurement.

-

|

Where to find always current domestic content module pricing and availability

How do you know what inventory of domestic content options is available and at what price for different delivery quarters? In part two of our Domestic Content 101 blog series,…

-

|

Domestic content 101: Understanding bonus credit requirements

Need help keeping up with the latest guidance for the domestic content bonus credit and determining what your domestic content strategy is?

-

|

The POWER Podcast: Mike Hall on Domestic Content and Maximizing Solar Project Incentives

Anza CEO, Mike Hall, joins the POWER Podcast discussing domestic content availability, solar tariffs, pricing trends, & much more.

-

|

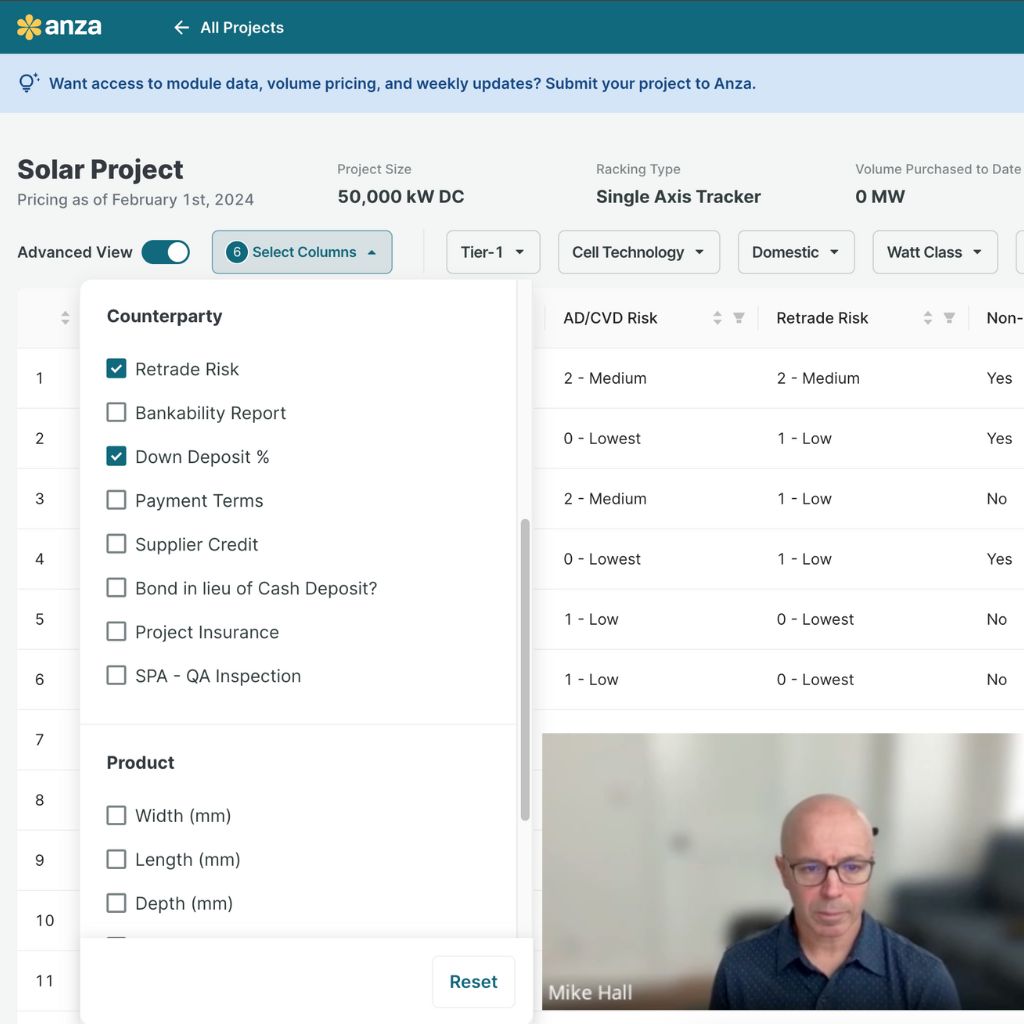

Platform Webinar: Solar Module Questions Answered with Anza’s Software

Discover the data & analytics available to help IPPs, developers, EPCs, & more answer module-related questions & make better decisions, faster.

-

|

Anza Customer Testimonial: ClearPath Energy

In this customer testimonial, hear how Anza serves as a trusted partner of ClearPath Energy, a solar developer owner-operator.

-

|

RE+ 2024 Exhibitor Showcase with SunCast Media

Nico Johnson of SunCast Media stopped by Anza’s booth at RE+ 2024 to speak with our CEO Mike Hall about how Anza’s data and technology platform is helping IPPs and…

-

|

Solar Data and Analytics Subscriptions from Anza

For the first time, solar module buyers and developers can access real-time supplier pricing and filter modules based on the industry’s leading database of technical specifications, trade risk, domestic content,…

-

|

New module AD/CVD case and bifacial import duties reinstated: What lower risk options do I have left?

With a new AD/CVD petition officially filed and bifacial import duties reinstated, here’s a breakdown of solar module procurement options to avoid additional duties over the coming months

-

|

Understanding Differences Between AC and DC-Integrated Energy Storage Systems

Not sure if an AC- or DC-integrated ESS is the right choice for your project? Here’s a closer look at the differences between the two systems and how Anza makes…

-

|

Accelerating solar and storage procurement with the Anza platform | Solar Builder

Anza’s CEO Mike Hall discusses the benefits Anza provides to solar and battery storage buyers in an episode of Solar Builder’s The Pitch video series.

-

|

Why we’re closely watching for new AD/CVD and Section 201 solar tariffs

Current intel suggests new AD/CVD and Section 201 solar tariffs could be coming soon. What steps can you take now to mitigate risk?

-

|

Mike Hall on DealMakers: From Garage Start-Up to Solar Industry Leader

Our CEO, Mike Hall, was recently on the DealMakers show with Alejandro Cremades. In this episode, you will hear about how Mike transformed a garage start-up into an industry-leading renewable…

-

|

Mike Hall on CleanTechies: Turning Internal Process Optimization Into A Tool for Solar Procurement Challenges

Anza’s CEO, Mike Hall, spoke with Silas Mähner and Somil Aggarwal on the CleanTechies podcast. In this episode, Mike gives background on the journey of starting Anza, diving into solar…

-

|

Entrepreneurs for Impact: Mike Hall Discusses Smarter Solar Procurement

Mike Hall, Anza’s CEO, joins host Dr. Chris Wedding on Entrepreneurs for Impact, a podcast dedicated to interviews with climate tech CEOs and investors. In this episode, they discuss Mike’s…

-

|

Solar Module Supply Chain, Technical & Commercial Information On Demand

Solar Module Supply Chain, Technical & Commercial Information On Demand Hear from Mike Hall, Anza’s CEO, about technical module and counterparty diligence challenges and how Anza’s new technical and risk-related…

-

|

Currents Podcast: Mike Hall on Solar Module Procurement & Anza’s Algorithms

Our CEO, Mike Hall, joined Currents from Norton Rose Fulbright, a podcast focused on the latest project finance developments for the renewable energy sector. In this episode, Mike discusses the…

-

|

Mike Hall on Solar Maverick: Innovating Solar & Energy Storage Procurement

Anza’s CEO Mike Hall went on Benoy Thanjan’s podcast, Solar Maverick to discuss procurement, Anza’s role in helping increase the value and velocity of solar and energy storage procurement, and…

-

Lodestar Energy Cuts Procurement Costs, Reduces Information Gathering & Negotiating Time by 50% with Anza

As a developer of commercial and public sector DG solar and ESS projects, Lodestar serves clients across New England…

-

Considerations for a successful financial analysis and solar module purchase

Considerations for a successful financial analysis and solar module purchase

-

|

What Anza customers need to know about recent solar policy updates

While the industry highly anticipated more information about the Uyghur Forced Labor Prevention Act (UFLPA), Inflation Reduction Act (IRA)…

-

|

Solar PV PAN Files Explained

In this blog from Anza’s product engine owner, we take a deeper look at PAN files and how Anza ensures that only the most bankable PAN files are included in…

-

|

How Technology Drives Value, Speed & Simplicity in Procurement: Anza’s Origin Story

In this Anza origin story, CTO Malini Balakrishnan talks about the early steps of Anza’s technology development and how her team harnessed…

-

|

How to Maximize Module Financial Value

Our recorded webinar provides insights into the levers and financial calculations to use to select the highest-value solar modules.

-

|

Which Optimization Levers Will Maximize Your Solar Module Value? (Webinar Recap)

The renewable energy industry is rapidly evolving and subject to sudden shifts in technology and supply chains.

-

Renewable Properties utilizes Borrego’s Anza marketplace to secure 96-MW of solar modules

Renewable Properties, a developer and investor in small-scale utility and community solar projects, has completed the purchase of 96…

-

The opportunities and challenges of large-format modules

Large-format modules present several opportunities and challenges for developers, engineering, procurement and construction (EPC) companies, and operations and maintenance (O&M) providers.